What is the best Small Business structure for Australian businesses? | Wollerman Shacklock Lawyers

The Best Structure for your Small Business

What’s your ‘Why’?

Before you get into business, you need to be asking yourself a very important question: Why?

Most individuals will ask ‘Why am I going into the [x/y/z] industry?’

But what they should really be asking is something even more fundamental: Why get into business at all? Why not simply stay at a job that provides a steady, reliable income, possibly even contributing to the growth of a company you love while not having to take any of the risks associated with starting a business?

The answer usually comes out as one-word, catch-all phrases like, ‘Freedom’, ‘Flexibility’, ‘Be my own boss!’ and those are great reasons.

But the main reason to get into business — besides having a larger vision of improving, somehow, the lives of others — is benefit.

Usually, this gets framed in terms of ‘profit’. But that’s simply too reductive.

It all boils down to benefit. Given the risks of starting and failing, no one in their right minds would start a new venture if it weren’t, in some way, beneficial for them. Just take a look at these survival rates for businesses from June 2011, as compared to June 2015.

Source: The Australian Small Business and Family Enterprise Ombudsman

According to Kate Carnell, the AO Australian Small Business and Family Enterprise Ombudsman, ‘The small business sector is very volatile, with non-employing small businesses having the lowest survival rate of all businesses in Australia.’

But she’s also quick to note that the adaptability of businesses is its survival mechanism.

‘Paradoxically, this ongoing creation and destruction of small businesses is an explanation for the adaptability and resilience of the small business sector. It enables new business ventures to quickly spring up to exploit new opportunities and promptly exit declining industries.’

So going into business is, at its core, all about benefit — to you, and to your potential customers.

And the best way to put the right foot forward is to begin with finding out which format of business, then, benefits your long-term growth plans the most.

Let’s break it down.

1) Sole Trader

Pick this structure if you’re planning to operate as a ‘solo’ operator. To get started, all you have to do is register the business name with the Australian Securities and Investment Commission (ASIC).

However, there is no separate legal entity created for the business, so you’d file the taxes on income from the business on your personal tax return.

Often, freelancers or small, one-person online shops may start off as a ‘sole trader’ because, technically, they don’t have anyone ‘on staff’. They are the business and the business is them.

While they can certainly sub-contract duties, they don’t have anyone on payroll. They’re legally responsible for all aspects of the business.

This is because the sole trader business structure does not recognise the business as separate from you. You receive all the profits, certainly, but you are also personally responsible for all debts or legal action taken against the person.

Liability, then, is the biggest reason why businesses choose ‘company’ over the ‘sole trader’ structure. The other reason they might choose a ‘company’ over a ‘sole trader’ structure is tax benefits that are set up specifically for a company.

Pros

- Easy and fast setup

- Sole control of all profits (as well as business decision-making)

Cons

- Not recognised as a separate business entity

- The individual is personally liable for all debts or legal actions filed against the ‘business’

2) Company (Limited Liability)

No pain, no gain, goes the saying. Not that running a ‘company’ is a pain — but some may find the filing of paperwork a little less simplistic (or instant), as compared to the sole trader structure.

However, in return, these businesses are afforded a degree of tax benefits and are shielded from personal liability.

When individuals register a business as a ‘company’, their filing with the ASIC forms a separate legal entity. It is this entity that files taxes, gains tax benefits, and takes up liability in case of legal action.

Choose this business structure if you plan to get into an industry or niche where there is a greater chance for risk or liabilities. You should also choose this business structure if you plan to hire employees and keep them on the payroll.

Note that, along with more extensive paperwork, it’s also more expensive to maintain and set up. Companies also require extensive record-keeping, come tax preparation time.

Pros

- A separate legal entity that limits financial liability to the company, not the business owner

- The company continues despite the sale of original owners or death of owners

- Corporation-specific tax benefits

- Improves your credibility with clients

Cons

- Extensive record-keeping and heavily regulated/watched over

- More expensive to form and maintain; changes need a professional consultation with legal or tax experts

3) Partnership

Three’s company. But two…is a partnership in business.

Choose this business structure if you plan on going into a ‘partnership’ with another individual and want to pool your resources (and skills) together for a stronger venture. In this case, you both are co-owners, which means you’ll need a partnership agreement.

Agreements usually include:

- Names of partners and stipulations about how new partners can be added

- An outline of the business

- The level of investment, liability, and subsequent profit share of each partner

- What happens when the partnership dissolves

Partnerships are very specific entities. Like a sole trader, there is no legal separation from the operations of the business.

This means all partners are on the hook, so to speak, regardless of who actually triggered the issue. In some cases, one partner may be responsible for more of the debt if the assets of others are not enough to fulfil the obligation.

Pros

- Partnerships allow for a larger available pool of capital, resources, and skills

Cons

- Require a partnership agreement to be drawn up

- All partners are jointly liable

- Personal stake means business relationships could get messy

- No separation of legal entity

4) Trust

Trusts are actually the oldest structures but they’ve evolved in many ways to modern day. They used to be used (and still are) to handle family inheritances and political activities, besides business purposes.

As a legal structure intended to hold assets, a trust has an appointed overseer, a trustee, to manage them. This trustee, then, acts as a manager of the business, paying bills and making decisions. They are recognised as a ‘company’, in their own right.

The main benefit of Trusts is that they are very flexible for tax purposes. On the flip side, however, they do have a complex legal structure and cost more to set up than any of the previous three business structures.

Because Trusts protect business assets, they are usually used to shield income from taxes. In and of themselves, Trusts have tax planning flexibility built right in because there are different tax-free thresholds and personal tax rates. This is usually the main purpose why Trusts are used as a business structure. Those who receive funds from a Trust’s disbursement are known as ‘beneficiaries’.

Pros

- Separate entity and management appointed to a trustee means limited liability

- Extremely tax flexible

Cons

- Complex business structure requires more legal expertise during set up

- Costs associated with set up are greater

Which Structure is Right for your Business?

It should be clear that every business structure has four main considerations:

- Your personal liability

- Your partners/investors

- The administrative and setup costs

- The tax benefits of the chosen structure

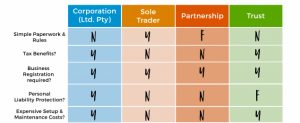

For a quick review of what each business structure offers, take a look at this table:

A mark of ‘N’ means ‘No’. ‘Y’ means ‘Yes,’ while ‘F’ means ‘Fair’.

Based on this, as well as the pros and cons outlined above, you should have a better sense of where your business will stand to benefit the most.

Keep in mind, as well, that how you start — which structure you choose — does not have to be how you intend to go on. Remember, adaptability is key to the survival of businesses.

So a sole trader can always ‘move up’ to company/corporation status. And a company/corporation can always dissolve and move back into sole trader status. Certainly, there is legal paperwork involved with that decision but it helps businesses to know they’re not locked in.

Sometimes, it’s more beneficial for a business during the initial startup phase to keep things as uncomplicated and smooth as possible. This is not only for costs’ sake but something far greater: the mindset of an entrepreneur and the positive psychological momentum experienced when things get up and running fast.

We have the ability to get in our own way and stall with too much planning. Sometimes, it’s smarter to get started on our dreams and take action right away.

Because businesses do deliver benefits but only when there is a bias to action.